Deepak Fertilisers and Petrochemicals Corporation Limited, one of India’s leading producers of industrial & mining chemicals and fertilisers (“DFPCL” or the “Company”), announced its results for the quarter ended September 30, 2024. The company reported a remarkable 237% year-on-year surge in net profits.

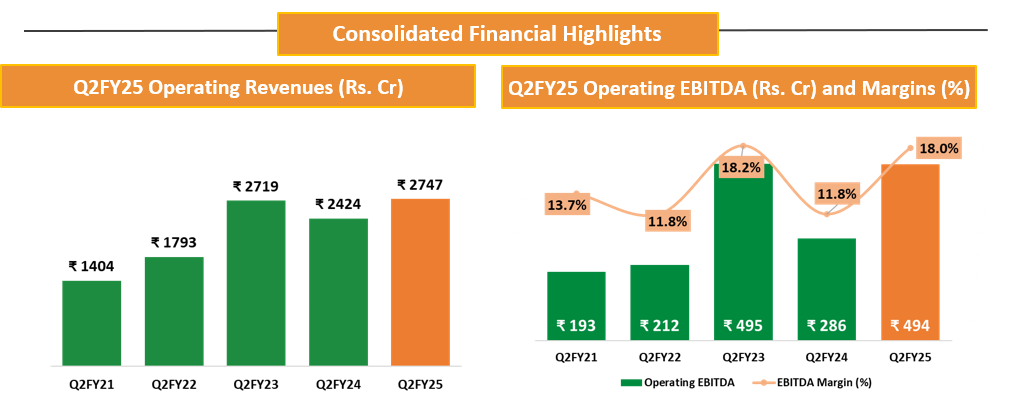

Consolidated Financial Highlights

Consolidated

(INR CR)

Q2FY25

Q2FY24*

YoY Change

Q1FY25

QoQ Change

H1FY25

H1FY24

YoY

Change

Operating Revenue

2,747

2,424

13%

2,281

20%

5,028

4,737

6%

Operating EBITDA

494

286

73%

464

6%

959

567

69%

Margins (%)

18%

12%

619 bps

20%

(237) bps

19%

12%

710 bps

Net Profit

214

63

237%

200

7%

414

177

134%

Margin (%)

8%

3%

518 bps

9%

(96) bps

8%

4%

449 bps

*Q2FY24 includes the impact of NBS subsidy on channel inventories of Rs. 106 Cr and Rs.87 Cr on account of stabilization of Ammonia Plant

Key Highlights for Q2FY25

EBITDA Margin Growth: Improved to 18% compared to 12% year-over-year.

Record Sales Volume in Bulk Fertilizer: Achieved an 83% year-over-year increase in sales volume of manufactured bulk fertilizer, marking the highest sales in a quarter.

Anti-Dumping Duty Implementation: USD 217 per metric ton Anti-Dumping Duty (ADD) on IPA for a period of 5 years.

In-House Capture of Ammonia Price Hikes: Increases in global ammonia prices are now fully captured internally.

Capacity enhancement of approximately 10% resulting from debottlenecking of the TAN plants, delivering an additional 50 KTPA and bringing the total TAN capacity volumes to 587 KTPA to support the growing needs of India’s Mining sector.

Debt Reduction: Prepaid Rs. 200 crores in debt, improving the Net Debt to EBITDA ratio from 2.66x to 1.64x.

Change in key RM Prices in Q2FY25: Ammonia: ~11% YoY; MOP: ~40% YoY; Gas: ~9% YoY

Commenting on the performance, Mr. Sailesh C. Mehta, Chairman & Managing Director said, DFPCL has shown impressive performance in Q2 FY25, achieving a 13% growth in revenue. This growth was primarily driven by the Crop Nutrition business, which experienced an 18% YoY increase in revenue, while the Chemical business grew by 8% YoY despite a lean quarter for the chemical sectors. Fertilizer and Chemical businesses acted as a natural hedge, enabling the company to deliver consistent and improved performance.

There has been a consistent increase in the proportion of revenue from specialty products, along with an overall rise in revenue, driven by the strategic move of transitioning from commodity to specialty.

Crop Nutrition Business (CNB) achieved a remarkable 83% YoY increase in sales volume of manufactured bulk fertilizer, which is highest ever sales.

Mining Chemical: Monsoon is a lean period due to slowdown in mining activities. Accordingly, we had taken a planned shutdown of Technical Ammonium Nitrate (TAN) plant for maintenance and capacity enhancement of 50 KTPA, taking total capacity to 587 KTPA.

The Industrial Chemicals business experienced a healthy revenue growth of 9%, despite marginal decrease in volumes. This performance underscores our strategic shift from commodities to specialty chemicals, which has effectively mitigated price volatility.

The ammonia plant has enabled all our businesses to reap substantial benefits from backward integration, effectively mitigating supply chain risks and price volatility. As a result, we are now able to capture the increases in global ammonia prices within the group.

As India continues to grow, the chemical and fertilizer sectors are poised to thrive. The demand outlook for the Crop Nutrition, Mining Chemicals, and Industrial Chemicals Business is well aligned with India’s growth story, providing strong and positive tailwinds. We are actively working on the execution of the TAN Project and the Nitric Acid Project in Gopalpur and Dahej, respectively, to capitalize on future growth.

Chemicals Review

Mining Chemicals (Technical Ammonium Nitrate):

In Q2 FY25, our premium product LDANs sales volume soared by 16% YoY and rose by an impressive 20% in H1 FY25 compared to H1 FY24

Overall sales volume was down by 21% YoY in Q2 due to a planned shutdown and lean seasons due to monsoon. The volumes were down by 1% in H1 FY25 compared to H1 FY24.

Business Outlook: The mining and infrastructure is expected to pick up post monsoon as demand for Power (Coal), Cement & Steel is expected to increase thereby providing robust support for TAN demand.

Industrial Chemicals:

Nitric acid volumes was marginally down by 1% on YoY basis and up by 13% on QoQ basis.

The specialty stainless steel grade nitric acid has received positive feedback from customers.

IPA volumes experienced a 10% YoY decline due to process constraints and a plant shutdown. However, the recent implementation of an ADD at USD 217 per metric ton for a period of five years is anticipated to enhance both demand and pricing moving forward.

Business Outlook: For Nitric Acid, the demand and margins are expected to be stable over the next few quarters. Propylene-based IPA demand and margins are expected to be stable and improve following the implementation of the ADD on Chinese suppliers over few quarters.

âCrop Nutrition Business (Fertilisers) Review

In Q2 FY25, manufactured bulk fertilizer has achieved highest ever sales volume of 268 KMT, an 83% YoY increase, driven by improved demand from above-average rains, which led to 102% Kharif crop sowing and positive market sentiment across all regions.

Sales volume of Croptek surged to 37 KMT, reflecting a 70% YoY growth, with continued focus on providing crop-specific solutions for targeted crops, including cotton, soybean, sugarcane, corn, grapes, pomegranate, and banana.

The company has recently launched premium water-soluble fertilizer grades.

Sale of specialty fertilizer Bensulf was 9 KMT, up 7% YoY.

Business Outlook: Above-normal monsoon rainfall in our core states has significantly enhanced groundwater table as well as water reservoirs for irrigation, which will help promising rabi season ahead.

âWe expect the acreages under rabi cash crops to go up especially for Sugarcane, Onion, Potato etc.

âCompany Overview

Deepak Fertilisers and Petrochemicals Corporation Ltd. (DFPCL) is among the India’s leading manufacturers of industrial chemicals and fertilisers. With a strong presence in Technical Ammonium Nitrate (mining chemicals), Industrial Chemicals and Crop Nutrition (fertilisers), the Company supports critical sectors of the economy such as infrastructure, mining, chemicals, pharmaceutical and agriculture. DFPCL is a publicly listed, multi-product Indian conglomerate and has plants located in four states, namely Maharashtra (Taloja), Gujarat (Daher), Andhra Pradesh (Srikakulam) and Haryana (Panipat).

DFPCL is Leading manufacturer and marketer of Iso Propyl Alcohol (IPA) in India and Largest Manufacturer of Nitric Acid in Southeast Asia. The Company is developing specialised grades of Nitric acid and IPA to meet specific requirements to cater needs of the industry/consumer.

DFPCL is one of the leading manufacturers of Technical Ammonium Nitrate in the world, it is the only producer of pilled Technical Grade Ammonium Nitrate solids and medical grade Ammonium Nitrate in India. The Company has commenced best in-class Technical Services to drive downstream productivity benefits for the mining end consumers.

CNB Segment (fertilisers) offers a basket of 48 products which include bulk fertilisers, Crop nutrient solutions, specialty fertilisers, water-soluble fertilisers, bio-stimulants, micro-nutrients, and secondary nutrients, catering to every crop’s nutrient requirement. Enhanced-efficiency speciality fertilisers are developed basis rigorous R&D efforts and product trials at over 50,000 farmer demo plots. The R&D efforts have shown distinct yield and quality improvements for crops across segments such as cotton, sugarcane, onion, fruits and vegetables. Over last three years, value-added nutrition products have benefitted 6 million farmers.

Deepak Fertilisers and Petrochemicals Corporation Limited, one of India’s leading producers of industrial & mining chemicals and fertilisers (“DFPCL” or the “Company”), announced its results for the quarter ended September 30, 2024. The company reported a remarkable 237% year-on-year surge in net profits.

Consolidated Financial Highlights

Consolidated

(INR CR)

Q2FY25

Q2FY24*

YoY Change

Q1FY25

QoQ Change

H1FY25

H1FY24

YoY

Change

Operating Revenue

2,747

2,424

13%

2,281

20%

5,028

4,737

6%

Operating EBITDA

494

286

73%

464

6%

959

567

69%

Margins (%)

18%

12%

619 bps

20%

(237) bps

19%

12%

710 bps

Net Profit

214

63

237%

200

7%

414

177

134%

Margin (%)

8%

3%

518 bps

9%

(96) bps

8%

4%

449 bps

*Q2FY24 includes the impact of NBS subsidy on channel inventories of Rs. 106 Cr and Rs.87 Cr on account of stabilization of Ammonia Plant

Key Highlights for Q2FY25

EBITDA Margin Growth: Improved to 18% compared to 12% year-over-year.

Record Sales Volume in Bulk Fertilizer: Achieved an 83% year-over-year increase in sales volume of manufactured bulk fertilizer, marking the highest sales in a quarter.

Anti-Dumping Duty Implementation: USD 217 per metric ton Anti-Dumping Duty (ADD) on IPA for a period of 5 years.

In-House Capture of Ammonia Price Hikes: Increases in global ammonia prices are now fully captured internally.

Capacity enhancement of approximately 10% resulting from debottlenecking of the TAN plants, delivering an additional 50 KTPA and bringing the total TAN capacity volumes to 587 KTPA to support the growing needs of India’s Mining sector.

Debt Reduction: Prepaid Rs. 200 crores in debt, improving the Net Debt to EBITDA ratio from 2.66x to 1.64x.

Change in key RM Prices in Q2FY25: Ammonia: ~11% YoY; MOP: ~40% YoY; Gas: ~9% YoY

Commenting on the performance, Mr. Sailesh C. Mehta, Chairman & Managing Director said, DFPCL has shown impressive performance in Q2 FY25, achieving a 13% growth in revenue. This growth was primarily driven by the Crop Nutrition business, which experienced an 18% YoY increase in revenue, while the Chemical business grew by 8% YoY despite a lean quarter for the chemical sectors. Fertilizer and Chemical businesses acted as a natural hedge, enabling the company to deliver consistent and improved performance.

There has been a consistent increase in the proportion of revenue from specialty products, along with an overall rise in revenue, driven by the strategic move of transitioning from commodity to specialty.

Crop Nutrition Business (CNB) achieved a remarkable 83% YoY increase in sales volume of manufactured bulk fertilizer, which is highest ever sales.

Mining Chemical: Monsoon is a lean period due to slowdown in mining activities. Accordingly, we had taken a planned shutdown of Technical Ammonium Nitrate (TAN) plant for maintenance and capacity enhancement of 50 KTPA, taking total capacity to 587 KTPA.

The Industrial Chemicals business experienced a healthy revenue growth of 9%, despite marginal decrease in volumes. This performance underscores our strategic shift from commodities to specialty chemicals, which has effectively mitigated price volatility.

The ammonia plant has enabled all our businesses to reap substantial benefits from backward integration, effectively mitigating supply chain risks and price volatility. As a result, we are now able to capture the increases in global ammonia prices within the group.

As India continues to grow, the chemical and fertilizer sectors are poised to thrive. The demand outlook for the Crop Nutrition, Mining Chemicals, and Industrial Chemicals Business is well aligned with India’s growth story, providing strong and positive tailwinds. We are actively working on the execution of the TAN Project and the Nitric Acid Project in Gopalpur and Dahej, respectively, to capitalize on future growth.

Chemicals Review

Mining Chemicals (Technical Ammonium Nitrate):

In Q2 FY25, our premium product LDANs sales volume soared by 16% YoY and rose by an impressive 20% in H1 FY25 compared to H1 FY24

Overall sales volume was down by 21% YoY in Q2 due to a planned shutdown and lean seasons due to monsoon. The volumes were down by 1% in H1 FY25 compared to H1 FY24.

Business Outlook: The mining and infrastructure is expected to pick up post monsoon as demand for Power (Coal), Cement & Steel is expected to increase thereby providing robust support for TAN demand.

Industrial Chemicals:

Nitric acid volumes was marginally down by 1% on YoY basis and up by 13% on QoQ basis.

The specialty stainless steel grade nitric acid has received positive feedback from customers.

IPA volumes experienced a 10% YoY decline due to process constraints and a plant shutdown. However, the recent implementation of an ADD at USD 217 per metric ton for a period of five years is anticipated to enhance both demand and pricing moving forward.

Business Outlook: For Nitric Acid, the demand and margins are expected to be stable over the next few quarters. Propylene-based IPA demand and margins are expected to be stable and improve following the implementation of the ADD on Chinese suppliers over few quarters.

âCrop Nutrition Business (Fertilisers) Review

In Q2 FY25, manufactured bulk fertilizer has achieved highest ever sales volume of 268 KMT, an 83% YoY increase, driven by improved demand from above-average rains, which led to 102% Kharif crop sowing and positive market sentiment across all regions.

Sales volume of Croptek surged to 37 KMT, reflecting a 70% YoY growth, with continued focus on providing crop-specific solutions for targeted crops, including cotton, soybean, sugarcane, corn, grapes, pomegranate, and banana.

The company has recently launched premium water-soluble fertilizer grades.

Sale of specialty fertilizer Bensulf was 9 KMT, up 7% YoY.

Business Outlook: Above-normal monsoon rainfall in our core states has significantly enhanced groundwater table as well as water reservoirs for irrigation, which will help promising rabi season ahead.

âWe expect the acreages under rabi cash crops to go up especially for Sugarcane, Onion, Potato etc.

âCompany Overview

Deepak Fertilisers and Petrochemicals Corporation Ltd. (DFPCL) is among the India’s leading manufacturers of industrial chemicals and fertilisers. With a strong presence in Technical Ammonium Nitrate (mining chemicals), Industrial Chemicals and Crop Nutrition (fertilisers), the Company supports critical sectors of the economy such as infrastructure, mining, chemicals, pharmaceutical and agriculture. DFPCL is a publicly listed, multi-product Indian conglomerate and has plants located in four states, namely Maharashtra (Taloja), Gujarat (Daher), Andhra Pradesh (Srikakulam) and Haryana (Panipat).

DFPCL is Leading manufacturer and marketer of Iso Propyl Alcohol (IPA) in India and Largest Manufacturer of Nitric Acid in Southeast Asia. The Company is developing specialised grades of Nitric acid and IPA to meet specific requirements to cater needs of the industry/consumer.

DFPCL is one of the leading manufacturers of Technical Ammonium Nitrate in the world, it is the only producer of pilled Technical Grade Ammonium Nitrate solids and medical grade Ammonium Nitrate in India. The Company has commenced best in-class Technical Services to drive downstream productivity benefits for the mining end consumers.

CNB Segment (fertilisers) offers a basket of 48 products which include bulk fertilisers, Crop nutrient solutions, specialty fertilisers, water-soluble fertilisers, bio-stimulants, micro-nutrients, and secondary nutrients, catering to every crop’s nutrient requirement. Enhanced-efficiency speciality fertilisers are developed basis rigorous R&D efforts and product trials at over 50,000 farmer demo plots. The R&D efforts have shown distinct yield and quality improvements for crops across segments such as cotton, sugarcane, onion, fruits and vegetables. Over last three years, value-added nutrition products have benefitted 6 million farmers.